can cash app report to irs

If you had income from crypto whether due to selling. Under orders from President Biden the IRS is cracking down on payments Americans receive through third-party apps and is now requiring Venmo PayPal and Cash App to report transactions if they.

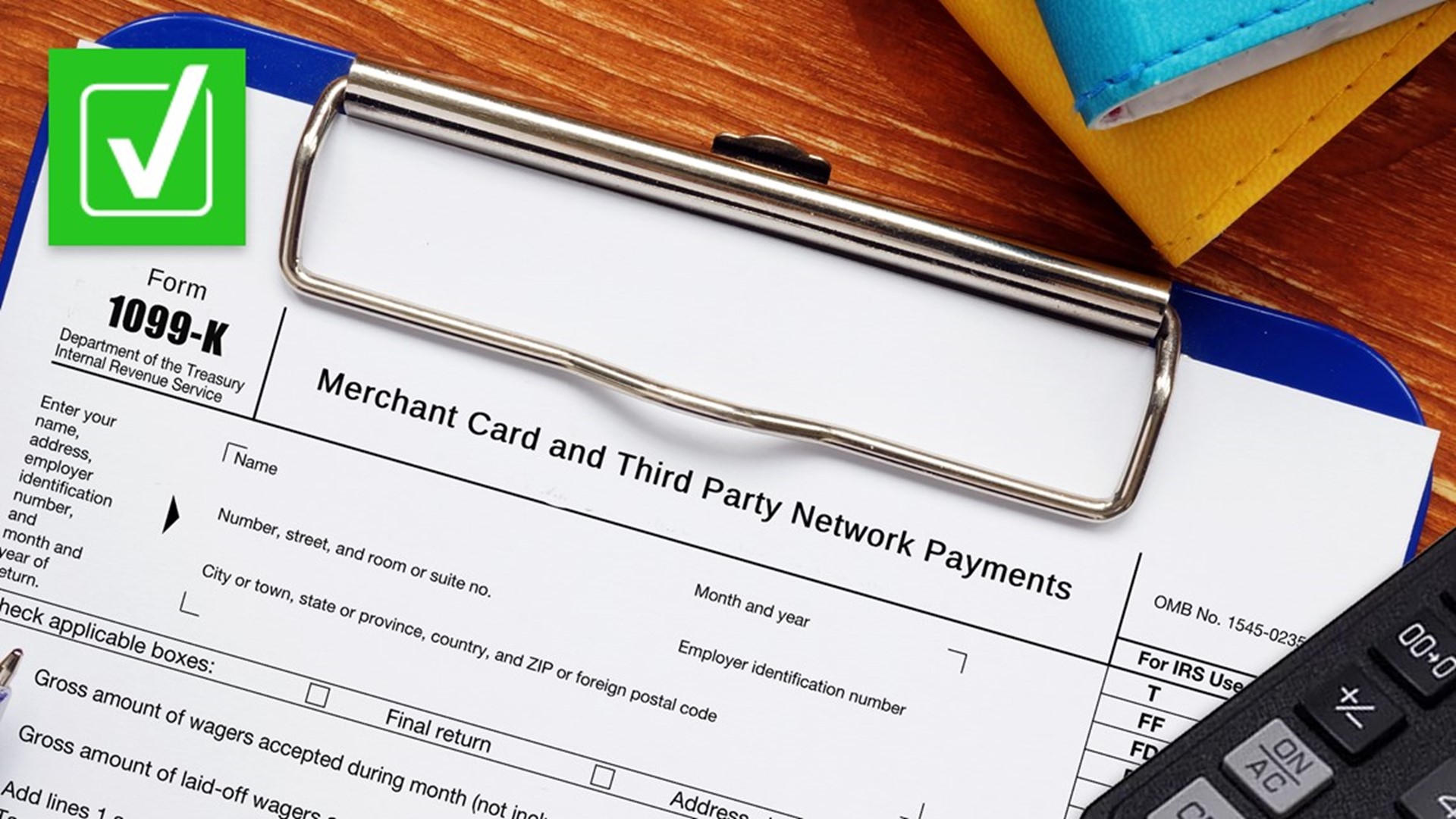

How To Report 1099 Nec Or 1099 K Income Using Cash App Taxes

Under the cash method you generally report income in the tax year you receive it and deduct expenses in the tax year in which you pay the expenses.

. The IRS has put a question about cryptocurrency holdings on page one of 2020 tax returns that taxpayers are expected to answer accurately. Or on the IRS2Go app under the Stay Connected tab. Cash contributions for individuals who do not itemize deductions.

Check hours available services and appointment options. Other scams involving Cash App include the classic IRS scam informing the user of a debt owed to the IRS or perhaps a different entity and asking for payment through the Cash App. Learn about the Cash App scams here as they emerge.

Millions of businesses accept electronic payments for their services but the IRS is cracking down on these types of payments which include. For tax years beginning in 2020 cash contributions up to 300 can be claimed on Form 1040 or 1040-SR line 10b. Enter the total amount of your contribution on line 10b.

Dont enter more than. There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan. Internal Revenue Service Tax Forms and Publications.

Or you can write to. If you use cash apps like Venmo Zelle or PayPal for business transactions some changes are coming to what those apps report to IRS.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

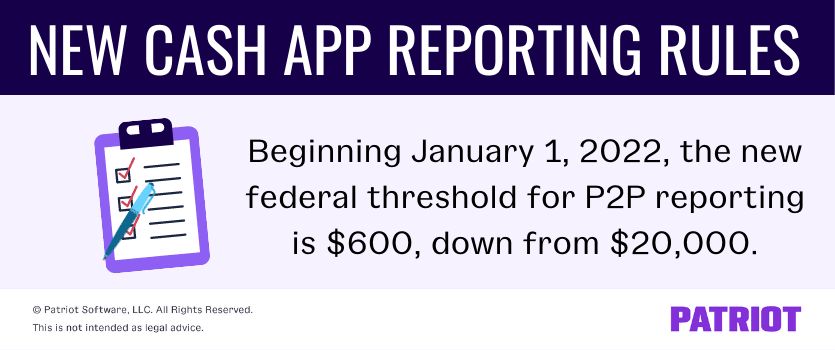

New Irs Rules For Cash Apps Transaction To Take Effect In 2022 Myparistexas

Changes To Cash App Reporting Threshold Paypal Venmo Zelle More

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Changes To Cash App Reporting Threshold Paypal Venmo Zelle More

Can Cash App Transactions Be Traced By Police Or Irs Unitopten

New Irs Rule Will Affect Cash App Business Transactions In 2022

5 Things To Know About Irs Plan To Tax Cash App Transactions

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

New Rule To Require Irs Tax On Cash App Business Transactions Wciv

Can Cash App Transactions Be Traced By The Irs And Police How To Track Your Cash App Card

Cash App Won T Have New Taxes In 2022 Despite Claims

New Irs Rule For Cash App Transactions Set To Go Into Effect Next Year

Nowthis If You Are Doing Business With Your Clients Using Third Party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

Can Cash App Transactions Be Traced By Police Or Irs Unitopten

New Tax Law Requires Cash Apps Report Transactions Of 600 To The Irs Venmo Paypal Zelle Apple Pay Youtube